*Please scroll down for helpful links and the latest updates.*

The coronavirus continues to directly impact retailers, their customers and employees nationwide.

North Carolina retailers’ first priority is, as always, the health and safety of their customers and employees.

And NCRMA’s first priority is, as always, to be the reliable resource for retailers who need answers, guidance and information. For that reason, NCRMA maintains close contact with state and federal officials and is constantly monitoring the coronavirus situation.

On this page we share updates, links to important documents, and provide industry specific information.

A&B Store Fixtures, a North Carolina-based, family-run NCRMA member, is stocking COVID-19 supplies that may be of interest to you. They are currently stocking KN95 masks, hand sanitizer and acrylic virus guards. For more information, pictures of the products available, and contact information for A&B, please link to: https://indd.adobe.com/view/b2641fdc-b675-419e-b868-9cd32c86c51d

If there is anything you need, please don’t hesitate to reach out.

HELPFUL LINKS

*Please scroll down for helpful links and the latest updates.*

OPTIONAL Signage: Masks Required by Local Order (8/20/21)

REQUIRED Signage: Face Covering Requirement

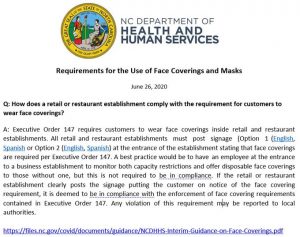

NC DHHS Requirements for the Use of Face Coverings and Masks

REQUIRED Signage: COVID Prevention Measures

REQUIRED Signage: Emergency Maximum Occupancy

REQUIRED Signage: Shop Smart

Signage: Consumers stay 6ft apart

Signage: ABC Permittees for Dine-In Closure

Signage: Other Dining Establishments for Dine-In Closure

Signage: Please wear a mask if you are not fully vaccinated

Social Distancing Guidance for Retailers

NC Retailers’ Special Shopping Hours

NCDHHS Checklist for Business Owners

NCRMA Summary Doc for FMLA/UI/SBA Info

CISA List (as of April 17th)

NCDOR Request To Be Considered an Essential Business

Centers of Disease Control and Prevention Webpage on the Coronavirus

OSHA Statement on the Coronavirus

There is no specific OSHA standard covering COVID-19. However, some OSHA requirements may apply to preventing occupational exposure to COVID-19. Among the most relevant are:

- 29 CFR 1910 Subpart I

- 29 CFR 1910.134

- Section 5(a)(1)

- Occupational Safety and Health (OSH) Act of 1970

Curbside Pickup and Delivery of Alcohol

Food Marketing Institute Coronavirus and Pandemic Preparedness for the Food Industry

National Retail Federation Resources for Retailers Concerning the Coronavirus

- NC Executive Order 224 (Issued July 28): Implementing Measures to Address COVID-19 and Related Variants

- NC Executive Order 220 (Issued June 11): State of Emergency Extended

- NC Executive Order 215 (Issued May 14): Lifting COVID-19 Restrictions to Reflect New Public Health Recommendations

- NC Executive Order 209 (Issued April 28): Removing the outdoor face covering requirements, Relaxing restrictions on gatherings, and extending the capacity and social distancing measures of EO 204

- NC Executive Order 204 (Issued March 23): Further Easing of Restrictions on Businesses and Gatherings

- NC Executive Order 195 (Issued February 24): Lifting the Modified Stay at Home Order and Easing Certain Restrictions on Businesses and Gatherings

- NC Executive Order 192 (Issued January 27): Hours of Service Transportation Waiver

- NC Executive Order 190 (Issued January 27): Mixed Beverages To-Go

- NC Executive Order 189 (Issued January 27): Further Extension of Stay at Home Order Until February 29

- NC Executive Order 183 (Issued December 21): Mixed Beverages (now incorporated into EO 190)

- NC Executive Order 181 (Issued December 8): Modified Stay at Home / Early Closure Order

- NC Executive Order 180 (Issued November 23): Face Covering Requirements

- NC Executive Order 169 (Issued September 30): Phase 3

- NC Executive Order 163 (Issued September 1): Phase 2.5 Reopen Plans for September 4

- NC Executive Order 162 (Issued September 1): Extends EO 153

- NC Executive Order 155 (Issued August 5): Phase 2 Extension

- NC Executive Order 153 (Issued July 28): Statewide alcohol sales restrictions

- NC Executive Order 151 (Issued July 16): Phase 2 Extension

- NC Executive Order 147 (issued June 24): Phase 2 Extension – Mask Mandate

- NC Executive Order 141 (issued May 20): Phase 2 Reopen Plans for May 22

- NC Executive Order 138 (issued May 5): Phase 1 Reopen Plans for May 8

- NC Executive Order 135 (issued April 23): Extends current stay-at-home order through May 8

- NC Executive Order 131 (issued April 9): Statewide Policies for Retail Establishments

- NC Executive Order 121 (issued March 27): Statewide Stay at Home Order

- NC Executive Order 120 (issued March 23): Closes all K-12 schools until May 15, limits mass gatherings to 50 people

- NC Executive Order 119 (issued March 20): Facilitates critical motor vehicle operations; expands access to health care

- NC Executive Order 118 (issued March 17): Limits operations of restaurants and bars

- NC Executive Order 117 (issued March 14): Closes all K-12 Schools and Prohibits Mass Gatherings over 100 People

- NC Executive Order 116 (issued March 10): Declaration of State of Emergency

As North Carolina continues to see an increase in COVID-19 cases, more local government officials are trying to navigate various ordinances and restrictions.

NCRMA President and General Counsel, Andy Ellen, sent a letter (click here) to the Mayors of the largest 30 Cities through the Metro Mayors as well as to the NC County Commissioners Association to forward to their members. The letter emphasizes that while NCRMA continues to oppose mask mandates due to the difficulty a patchwork of restrictions across the state and for the safety of its members’ store associates, that in the event a local government chooses to implement a mask mandate that retailers should not be required to be the enforcement authority for such a mask mandate.

Click here to view the complete PDF with updated information.

As North Carolina continues to see an increase in COVID-19 cases, more local government officials are trying to navigate various ordinances and restrictions.

NCRMA President and General Counsel, Andy Ellen, sent a letter (click here) to the Mayors of the largest 30 Cities through the Metro Mayors as well as to the NC County Commissioners Association to forward to their members. The letter emphasizes that while NCRMA continues to oppose mask mandates due to the difficulty a patchwork of restrictions across the state and for the safety of its members’ store associates, that in the event a local government chooses to implement a mask mandate that retailers should not be required to be the enforcement authority for such a mask mandate.

Below is an updated list of localities with mask mandates in place:

- NEW! Buncombe County may approve an order as early as today, August 17, 2021.

- City of Asheville will soon implement a mask mandate in businesses and other indoor settings.

- NEW! City of Winston-Salem issued a requirement for face coverings indoors within city limits beginning on Friday, August 20, 2021 at 5:30 pm EST.

- Durham County/City of Durham has issued a mask ordinance for employees and patrons within all indoor public places, businesses, and establishments that went into effect on August 9th, 2021 at 5:00 pm EST. While there are exemptions, the mandate will apply to anyone over the age of 5.

- UPDATED! Guilford County/City of Greensboro passed an indoor countywide mask mandate for individuals in businesses, establishments, and public places, which was delayed after realizing that a 10-day notice period was required prior to enforcing the mandate. The order will now take effect on Thursday, August 26, 2021 at 5:00 pm EST.

- UPDATED! Mecklenburg County will issue a countywide mask mandate, which will be voted on Wednesday during a special meeting of the County Board of Commissioners. The countywide public health rule could go into effect 10 days after approval (August 28, 2021) and would include six towns: Cornelius, Davidson, Huntersville, Matthews, Mint Hill, and Pineville.

-

- City of Charlotte will issue a requirement for face coverings indoors within city limits beginning Wednesday, August 18, 2021 at 5:00 pm EST. This requirement will be in place regardless of a person’s vaccination status.

- NEW! New Hanover County will issue a countywide mask mandate, which will go into effect Friday, August 20, 2021 at 5:00 pm EST. The mandate was implemented through a health rule that requires 10 days public notice, but the County HHS Director issued interim guidance to require compliance effective August 20, 2021. The rule would apply in all indoor locations to any individual over the age of 2, regardless of vaccination status.

- Orange County requires everyone over the age of 2 to wear a mask inside public spaces, including businesses as of August 11, 2021 at 5:00 pm EST. It applies throughout the county, including in the towns of Carrboro, Chapel Hill, and Hillsborough, and has been extended indefinitely.

- The Town of Boone declared a new local State of Emergency that includes a requirement for face coverings and social distancing indoors for the general public which includes any employees, customers or other occupants of businesses two years of age or older. The only noted exceptions are for health reasons or if you are seated at a restaurant. The order became effective Tuesday, August 10, 2021, at 5:00 pm EST.

- Wake County also intends to revise their current State of Emergency to include requirements for face coverings indoors, which would become effective by the end of this week. This Wake County requirement would apply to unincorporated areas, while the twelve municipalities within Wake County would make their own decisions on any local requirements. People are exempt from wearing a face covering if they are worshipping in a religious setting, at a funeral service, exercising their First Amendment rights, have a medical condition or are disabled.

-

- NEW! Town of Cary will issue a requirement for face coverings indoor within city limits beginning on Wednesday, August 18, 2021 at 5:00 pm EST. This requirement will be in place regardless of a person’s vaccination status for anyone over the age of 5.

- NEW! Town of Knightdale enacted an indoor face covering requirement for both public and private settings that went into effect on Sunday, August 15 at 5:00 pm EST.

- City of Raleigh issued a mask mandate, which went into effect on Friday August 13, 2021 at 5:00 pm EST.

- Apex, Fuquay-Varina, Wake Forest, and Holly Springs indicated that they will not require masks at this time.

As North Carolina continues to see an increase in COVID-19 cases, more local government officials are trying to navigate various ordinances and restrictions.

NCRMA President and General Counsel, Andy Ellen, sent a letter (click here) to the Mayors of the largest 30 Cities through the Metro Mayors as well as to the NC County Commissioners Association to forward to their members. The letter emphasizes that while NCRMA continues to oppose mask mandates due to the difficulty a patchwork of restrictions across the state and for the safety of its members’ store associates, that in the event a local government chooses to implement a mask mandate that retailers should not be required to be the enforcement authority for such a mask mandate.

Below is an updated list of localities with mask mandates in place:

- NEW! City of Raleigh announced that a mask mandate will go into effect today, Friday August 13, 2021 at 5:00 pm EST.

- New! Wake County also intends to revise their current State of Emergency to include requirements for face coverings indoors, which would become effective by the end of next week. This Wake County requirement would apply to unincorporated areas, while the twelve municipalities within Wake County would make their own decisions on any local requirements. Municipalities within Wake County include: Apex, Cary, Fuquay-Varina, Garner, Holly Springs, Knightdale, Morrisville, Raleigh, Rolesville, Wake Forest, Wendell, and Zebulon. NCRMA will send additional information as any orders are released next week.

- Orange County will require everyone over the age of 2 to wear a mask inside public spaces, including businesses, starting today, August 11, 2021 at 5:00 pm EST. The county updated its emergency declaration Tuesday in response to rising COVID-19 cases. It applies throughout the county, including in the towns of Carrboro, Chapel Hill, and Hillsborough, and has been extended indefinitely.

- Guilford County passed an indoor countywide mask mandate for individuals in businesses, establishments, and public places. The order takes effect on Friday, August 13, 2021 at 5:00 pm EST.

- The Town of Boone declared a new local State of Emergency that includes a requirement for face coverings and social distancing indoors for the general public which includes any employees, customers or other occupants of businesses two years of age or older. The only noted exceptions are for health reasons or if you are seated at a restaurant. The order became effective Tuesday, August 10, 2021, at 5:00 pm EST.

- Durham County/City of Durham has issued a mask ordinance for employees and patrons within all indoor public places, businesses, and establishments that went into effect on August 9th, 2021 at 5:00 pm EST. While there are exemptions, the mandate will apply to everyone ages five and older.

Durham County Order

For a full list of resources provided by NCRMA, including signage, visit www.ncrma.org/coronavirus.

UPDATE: July 28, 2021 - Governor Cooper Implements Measures to Address COVID-19 and Related Variants

This afternoon, North Carolina Governor Roy Cooper issued Executive Order 224 (click here) with guidance aimed at slowing the spread of COVID-19, but he did NOT issue a new mask mandate. During the Press Conference, Governor Cooper announced that as of today, the State has had 1,044,877 cases; 3,268 new cases reported since yesterday with 1,141 people in the hospital. Governor Cooper’s latest Executive Order specifically directs North Carolina Cabinet agencies to verify whether their employees are vaccinated, and further requires that unvaccinated employees continue to be tested on a weekly basis and continue wearing a mask.

Executive Order 224

Executive Order 224 FAQ

NC DHHS Guidance: Protecting Each Other from COVID-19

For the business community, Governor Cooper strongly encourages following the latest CDC guidance, and noted that nothing prohibits or discourages private businesses from setting their own store policies requiring face coverings for their employees or guests. The Governor’s Office does encourage businesses to post signage requesting that visitors who are not vaccinated to wear a mask, but there is no requirement to do so. Lastly, the NC Department of Health and Human Services recommends that employers should:

- Require employees to report vaccination status. Require employees who are not fully vaccinated to:

- If collecting vaccination status from employees is not possible, require all employees to wear face coverings indoors and participate in screening and testing programs.

- Encourage fully vaccinated employees to wear a face covering indoors when within 6 feet of other people if they are in an area of high or substantial levels of transmission as defined by the CDC.

- Post signage saying all employees and visitors should wear a face covering in areas of high and substantial transmission.

- Remind all employees, visitors, and patrons to self-monitor and get tested if they have symptoms of COVID-19.

COVID Liability Waiver Signage – NCRMA has updated signage per this latest Executive Order and guidance, in accordance with NCGS 99E-71 that an employer may post to provide immunity from liability due to COVID-19.

Face Covering Information:

- Nothing prevents people from continuing to wear face coverings, which are recommended for unvaccinated people and for all people in large venues.

- Employers, business owners, and local governments may require face coverings and social distancing.

Local governments are not preempted from implementing stricter COVID-19 face covering, capacity, and social distancing requirements. NCRMA will continue to monitor local orders as they are enacted.

This afternoon Governor Cooper issued Executive Order 220 which extends certain measures contained in Executive Order 215 intended to prevent further spread of COVID-19. Executive Order 220 becomes effective June 11, 2021 at 5:00 pm and will remain in effect under July 30, 2021 at 5:00 pm. https://files.nc.gov/governor/documents/files/EO220-Extension-of-EO215.pdf

Governor Cooper pointed to additional FEMA Public Assistance reimbursements, and that schools can follow uniform safety guidance under the StrongSchoolsNC Public Health Toolkit as justifications for the extension of the State of Emergency as well as additional flexibility for telehealth and administration of COVID-19 vaccines.

With regards to masks, they will still be required in certain settings such as public transportation, schools, health care and childcare facilities, in accordance with CDC guidance. Private businesses may also continue to require masks if they wish to do so.

Finally, while the Executive Order prevents local governments from restricting the administration of COVID-19 vaccinations or COVID-19 testing, a local government is not prohibited from implementing additional measures concerning COVID-19.

This afternoon, North Carolina Governor Roy Cooper issued Executive Order 215 announcing that capacity restrictions and social distancing requirements, should be lifted in all settings and the general face covering requirement should be lifted in most settings. (Face coverings are still required in several health care settings, schools, transportation settings like airports and bus stations, correctional and detention facilities, and at homeless service providers.) The Order becomes effective today, May 14, 2021 at 1:30 pm and will remain in effect through June 11, 2021 at 5:00 pm. NCRMA has been in constant contact with the Governor Cooper’s Office and North Carolina Department of Health and Human Services throughout the pandemic including discussions about removing the mask mandates.

In Governor Cooper’s press conference, when asked how his personal behavior would be impacted by this latest guidance, he responded, “If I went to a grocery store that was not requiring masks, I would not wear my mask in the grocery store and would feel comfortable going more places without my mask. I think it’s a good thing. I want to abide by whatever a retail establishment would do and also want to abide by mandatory mask rules in those certain settings.”

The order does not prohibit or discourage private businesses from setting their own store policies requiring face coverings for their employees or guests. The Governor did encourage businesses to post signage requesting people who aren’t vaccinated to wear a mask but there is no requirement to do so.

Executive Order 215

Frequently Asked Questions

Press Release

COVID Liability Waiver Signage – NCRMA has updated signage per this latest Executive Order and guidance, in accordance with NCGS 99E-71 that an employer may post to provide immunity from liability due to COVID-19.

Face Covering Information:

- Nothing prevents people from continuing to wear face coverings, which are recommended for unvaccinated people and for all people in large venues.

- Employers, business owners, and local governments may require face coverings and social distancing.

- Because children are still unvaccinated and can easily spread COVID-19, face coverings are still required in child care, children’s day camps, and children’s overnight camps.

- Nothing in today’s Executive Order changes the StrongSchoolsNC Toolkit requirement for face coverings in schools.

- The CDC has advised that face coverings should continue to be required in several health care settings, in transportation settings like airports and bus stations, in correctional and detention facilities, and at homeless service providers. This Order continues those face covering requirements.

Local governments are not preempted from implementing stricter COVID-19 face covering, capacity, and social distancing requirements. NCRMA will continue to monitor local orders as they are enacted.

Yesterday, NC Governor Roy Cooper issued Executive Order 209 further lifting restrictions for May following continued stability in COVID metrics and more vaccination progress. North Carolina has administered over 7 million doses. 48.7% percent of those 18 and up are at least partially vaccinated, and 39.2% percent of those 18 and up have been fully vaccinated. The Governor announced a goal of having at least 2/3’s of the state’s population at least partially vaccinated in order to lift the indoor mask mandate.

- Executive Order No. 209 will take effect April 30 and is set to expire June 1, at which time the Governor anticipates further easing of restrictions.

- Under EO 209, masks will still be required indoors but are no longer mandated outdoors. Masks are still strongly recommended by NC DHHS outdoors in crowded areas and higher risk settings where social distancing is difficult.

- Mass Gathering Limits: The number of people who may gather indoors will increase from 50 to 100 and the number of people who may gather outdoors will increase from 100 to 200. Occupancy limits currently in place will remain the same.

Executive Order 209

EO 209 Frequently Asked Questions

Press Release

COVID Metrics Slides

As a reminder, under this new EO 209, Retailers must continue to comply with the following requirements:

- Post the Emergency Maximum Occupancy in a noticeable place:

-100% for retail businesses or outdoor areas of restaurants;

-75% for indoor spaces of restaurants and fitness facilities;

-50% for indoor & outdoor areas of bars, meeting spaces, conference centers and reception venues; and

-Limit the number of guests in the store so that everyone can stay six (6) feet apart - Mark six (6) feet of spacing in lines at point of sale and other high traffic areas for guests, such as at deli counters and near high-demand products.

- Post signage reminding guests and workers about social distancing (staying at least 6 feet away from others) and requesting that people who have COVID-19 symptoms not enter.

- Immediately isolate and remove sick workers.

Clean surfaces once a day, prioritizing high-touch surfaces. If there has been a sick person or an individual who has tested positive for COVID-19 within the past 24 hours onsite at an establishment, clean and disinfect the space using an EPA-approved disinfectant for SARS_CoV-2.

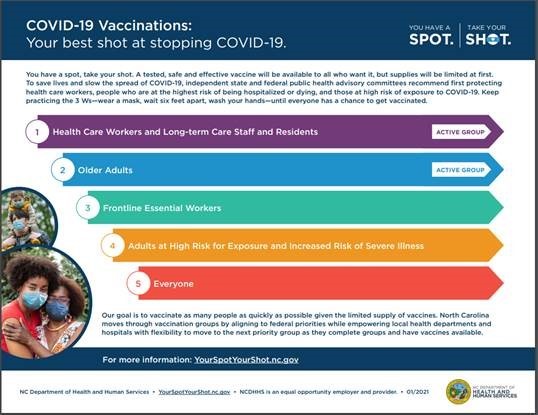

This afternoon, NC Governor Cooper again expedited the vaccine prioritization timeline. All of Group 4, which includes essential workers that have not yet been vaccinated, will be eligible beginning on March 31st (one week earlier than the originally anticipated date of April 7th). The Governor also announced the State will open eligibility to Group 5 on April 7th, which means, at that point, all adults (over 16 years of age) will be eligible for the vaccine.

Remaining Eligibility Timelines:

Eligible beginning March 17 – Portions of Group 4

- North Carolinians with high-risk medical conditions, people experiencing homelessness, and those that are incarcerated that have not been vaccinated.

Eligible March 31

- Essential workers not yet vaccinated to include all other retail employees (such as electronic, furniture, department, hardware, clothing, etc.) that were not eligible under Group 3. The CDC also defines essential workers as those in transportation and logistics, water and wastewater, food service, shelter and housing (e.g., construction), finance (e.g., bank tellers), information technology and communications, energy, legal, media, public safety (e.g., engineers) and public health workers.

- Students and others in congregate living.

Eligible April 7

- All North Carolinian adults (16+).

Other Currently Eligible Groups:

As a reminder, NC continues to vaccinate eligible individuals in Group 1: Health care workers & Long-Term Care staff and residents; Group 2: Anyone 65 years or older, regardless of health status or living situation; and Group 3: Frontline Essential Workers.

Front-line essential workers that are front-line employees who work in businesses that sell food, beverages and medicine including but not limited to those that work in the following types of stores: grocery, pharmacy, convenience, supercenters, warehouse clubs, wine and bottle shops and dollar stores as well as distribution centers supporting these businesses. Front-line restaurant, brewery and winery workers are also included in Group 3 Front-Line Essential Workers.

Additional Resources from NC Department of Health and Human Services:

- Find My Vaccine Group: http://findmygroup.nc.gov

- COVID-19 Vaccine Help Center: 888-675-4567

- Find A Vaccine Location: http://myspot.nc.gov/map-view

- Spanish-Language Resources: http://Vacunate.nc.gov

Please continue to educate your employees on the importance of the vaccine and assist them in where they can get vaccinated.

This afternoon, NC Governor Cooper announced Executive Order 204, which will ease some COVID restrictions in light of COVID metrics continuing to improve. This comes as the Governor announced that 32% of North Carolinians are partially vaccinated and 19% are now fully vaccinated. The order will become effective this Friday, March 26 at 5:00pm.

At NCRMA’s request, the new order removes the occupancy requirement for retailers and they may now have 100% occupancy or 24 people per 1,000 square feet. While continuing to require masks and social distancing, lower risk settings will be allowed to open up to full capacity, medium risk settings will be allowed to open up to 75% capacity indoors, and higher risk settings will be open up to 50%.

Executive Order 204

EO 204 Frequently Asked Questions

Governor Cooper Press Release

EO 204 is effective this Friday, March 26, 2021 at 5:00pm.

Changes included in EO 204 are noted below:

- Lower risk settings that can now open up to full capacity include: retail shopping businesses, child care, camps, outdoor playgrounds, personal care businesses, and museums.

- Medium risk settings that are now open up to full capacity outdoor and up to 75 percent indoor include restaurants, breweries, wineries, gyms, pools and amusement parks.

- Higher risk settings that can open up to 50 percent capacity include stadiums and arenas, conference spaces, reception spaces, movie theaters, gaming, and bars.

- Mass gathering limit increased to 50 people indoors and 100 people outdoors (from 25 and 50).

Requirements Remaining in place:

- Retail businesses are required to have all employees and guests wear face coverings

- Mark six feet of spacing in lines at point of sale and other high-traffic areas

- Follow the core signage, screening and sanitation requirements as defined in EO 204, Appendix A (see http://ncrma.org/coronavirus/) including occupancy limit signs. We are working to get this clarified, but until that time we encourage you to continue to post this sign.

- The allowance for mixed beverages to-go will continue through March 31

Don’t hesitate to reach out to NCRMA with any questions.

| This afternoon, Governor Cooper again expedited the vaccine prioritization timeline, allowing individuals with underlying health conditions or in congregate living settings to be eligible beginning next Wednesday, March 17th (one week earlier than the originally anticipated date of March 24th).

The remainder of Group 4, which includes essential workers that have not yet been vaccinated, will be eligible beginning on April 7th. Eligible March 17

NC continues to vaccinate eligible individuals in Group 1: Health care workers & Long-Term Care staff and residents; Group 2: Anyone 65 years or older, regardless of health status or living situation; and Group 3: Frontline Essential Workers. As a reminder, those currently eligible in Group 3 includes front-line essential workers that are front-line employees who work in businesses that sell food, beverages and medicine including but not limited to those that work in the following types of stores: grocery, pharmacy, convenience, supercenters, warehouse clubs, wine and bottle shops and dollar stores as well as distribution centers supporting these businesses. Front-line restaurant, brewery and winery workers are also included in Group 3 Front-Line Essential Workers.

NCRMA has drafted this (optional) letter you can provide to your employees stating that they qualify as a Group 3 Essential Worker. Additional Resources from NC Department of Health and Human Services:

|

As you received from NCRMA this morning, Governor Cooper announced that Group 3 frontline essential workers will be eligible for vaccinations beginning tomorrow, March 3 (originally slated for March 10). It was also announced that Group 4 (which includes other frontline essential workers not included in Group 3) is planned to begin on March 24. Additional clarifications were also added to the definition of high-risk medical conditions to include people with intellectual and developmental disability and neurological conditions. See below for additional detail on Group 3 and Group 4 Essential Worker designations as well as the complete update from NC DHHS.

Included in Group 3: Front-Line Essential Workers are front-line employees who work in businesses that sell food, beverages and medicine including but not limited to those that work in the following types of stores: grocery, pharmacy, convenience, supercenters, warehouse clubs, wine and bottle shops and dollar stores as well as distribution centers supporting these businesses. Front-line restaurant and brewery workers are also included in Group 3 Front-Line Essential Workers.

- NOTE: Other retail employees such as electronic, furniture, department, hardware, clothing, etc. are not included in Group 3 but are included in Group 4.

NCRMA has drafted this (optional) letter you can provide to your employees stating that they qualify as a Group 3 Essential Worker

- Anyone 16-64 years old with high-risk medical conditions that increase risk of severe disease from COVID-19 such as cancer, COPD, serious heart conditions, sickle cell disease, Type 2 diabetes, among others, regardless of living situation

- Anyone who is incarcerated or living in other close group living settings who is not already vaccinated due to age, medical condition or job function

- Essential workers not yet vaccinated. The CDC defines these as workers in transportation and logistics, water and wastewater, food service, shelter and housing (e.g., construction), finance (e.g., bank tellers), information technology and communications, energy, legal, media, public safety (e.g., engineers) and public health workers

Today’s NC DHHS update regarding COVID-19 vaccine administration in the state

- Group 1: The definition of long-term care in Group 1 has been updated to include a broader definition of Long Term Care. Long-term care includes people receiving long- term home care for more than 30 days including Home and Community Based Services for persons with intellectual and/or developmental disabilities, private duty nursing, personal care services, and home health and hospice. Learn more – Deeper Dive Group 1: Health Care Workers and Long-Term Care Staff and Residents.

- Group 3: Additional Frontline Essential Workers will be eligible for vaccine beginning on Wednesday, March 3. With the authorization of the Johnson & Johnson one-shot vaccine, we now have another tested, safe and effective COVID-19 vaccine to protect-against virus-related hospitalization and death. With three vaccines, North Carolina can get more people vaccinated sooner. Learn More – Deeper Dive Group 3: Frontline Essential Workers

a. Please be sure to share our video with Frontline Essential Workers talking about why they plan to take their shot (English / Spanish) and our video with Agricultural Workers (Spanish)

- Group 4:

a. Definitions of high risk medical conditions have been clarified. High-risk medical conditions include Intellectual and Developmental Disabilities, including Down Syndrome, and neurologic conditions, such as dementia and schizophrenia.

b. North Carolina will plan to move to Group 4, beginning on March 24- Beginning with anyone with conditions that have been identified by the CDC as increased risk for severe COVID-19 illness and anyone who is living in congregate or close group living settings who is not already vaccinated including, people experiencing homelessness or living in a homeless shelter and people in a correctional facility, such as jail or prison. Learn more – Deeper Dive Group 4: Adults at Higher Risk of Exposure and Increased Risk of Severe Illness (Higher-Risk Conditions and Additional Congregate Settings).

- Then moving to other essential workers and people in lower risk group living settings – Learn More – Deeper Dive Group 4: Adults at High Risk for Exposure and Increased Risk of Severe Illness (Essential Workers Not Yet Vaccinated and Other Group Living Settings)

Currently eligible groups: health care workers, long-term care staff and residents, people 65 and older, and child care and school staff – will continue to be prioritized. Some vaccine providers may not be ready to open to frontline essential workers on March 3 if they are still experiencing high demand for vaccines in Groups 1, 2, and 3 (child care and school staff).

As always, we rely on you as a trusted messenger to help people make informed decisions. NC DHHS has developed a suite of resources to support your outreach efforts. Please visit YourSpotYourShot.nc.gov and vacunate.nc.gov as we regularly add new materials. Our communications toolkit includes:

- Video Library

- Social Media Graphics

- Flyers

- Website and Newsletter Graphics

- Postcards

- Presentation

The North Carolina Retail Merchants Association has learned that today at 2:00 pm, Governor Cooper will announce beginning Wednesday, March 3, 2021, Group 3 Front-Line Essential Workers will be eligible to receive the COVID-19 Vaccine. This is earlier than the previously announced date of March 10, 2021. We are also hearing that Group 4 Essential Workers may be scheduled as early as March 24, 2021 (Click Here). Please see the information we sent yesterday and begin contacting your local public health department and hospital immediately.

It appears counties will be allowed to make their own determinations about who receives the vaccine. More clarification about that will come after the Governor’s 2:00 announcement.

Included in Group 3 Front-Line Essential Workers are front-line employees who work in businesses that sell food, beverages and medicine including but not limited to those that work in the following types of stores: grocery, pharmacy, convenience, supercenters, warehouse clubs, wine and bottle shops and dollar stores as well as distribution centers supporting these businesses. Front-line restaurant and brewery workers are also included in Group 3 Front-Line Essential Workers.

NCRMA has made numerous requests for a statewide vaccination registration system where employers can upload a list of their employees but, instead, it appears that vaccination registration and appointments will be conducted on a local level. This leaves you with a few options:

- If you have not already done so, as soon as possible, we strongly encourage you to reach out to your local public health department and/or hospital in the county where each of your stores is located. Ask your local public health department if they can arrange to either come on-site to your location(s) to administer the vaccination or if they can make appointments for your eligible employees. Below is the link to a list of public health departments in North Carolina:

https://www.ncdhhs.gov/divisions/public-health/county-health-departments - Below is the link to a database that your employees, or you, can input a zip code and a list of vaccine providers in the surrounding area will be displayed. Again, we strongly encourage you and your employees to begin outreach to administering providers today.

https://myspot.nc.gov/ - If you have a relationship with an occupational health provider in your community, that has access to the vaccination, contact them about coming on-site to your location to vaccinate your employees.

Finally, here is the link to the letter you can provide to your employees stating that they qualify as a Group 3 Essential Worker (Click Here)

Since the beginning of COVID, in March 2020, the NCRMA team has stood ready to assist you in any way we could and we are happy to provide assistance with questions concerning the administration of vaccines.

On Wednesday, March 10, 2021, Group 3 Front-Line Essential Workers become eligible for the COVID-19 vaccination. Included in Group 3 Front-Line Essential Workers are front-line employees who work in businesses that sell food, beverages and medicine including but not limited to those that work in the following types of stores: grocery, pharmacy, convenience, supercenters, warehouse clubs, wine and bottle shops and dollar stores as well as distribution centers supporting these businesses. Front-line restaurant and brewery workers are also included in Group 3 Front-Line Essential Workers.

NCRMA has made numerous requests for a statewide vaccination registration system where employers can upload a list of their employees but, instead, it appears that vaccination registration and appointments will be conducted on a local level. This leaves you with a few options:

- If you have not already done so, as soon as possible, we strongly encourage you to reach out to your local public health department and/or hospital in the county where each of your stores is located. Ask your local public health department if they can arrange to either come on-site to your location(s) to administer the vaccination or if they can make appointments for your eligible employees. Below is the link to a list of public health departments in North Carolina:

https://www.ncdhhs.gov/divisions/public-health/county-health-departments

- Below is the link to a database that your employees, or you, can input a zip code and a list of vaccine providers in the surrounding area will be displayed. Again, we strongly encourage you and your employees to begin outreach to administering providers today.

https://myspot.nc.gov/

- If you have a relationship with an occupational health provider in your community, that has access to the vaccination, contact them about coming on-site to your location to vaccinate your employees.

Finally, here is the link to the letter you can provide to your employees stating that they qualify as a Group 3 Essential Worker (Click Here)

Since the beginning of COVID, in March 2020, the NCRMA team has stood ready to assist you in any way we could and we are happy to provide assistance with questions concerning the administration of vaccines. Timelines for administration of Group 4 (Click Here) have not yet been released but NCRMA will keep you apprised as additional information regarding those front-line workers in Group 4 becomes available.

This afternoon, NC Governor Cooper announced Executive Order 195 which will ease some COVID restrictions in light of COVID metrics continuing to improve. The order will become effective this Friday, February 26 at 5:00pm and remains in effect through Friday, March 26 at 5:00pm. At NCRMA’s request, the new order removes the requirement for retailers over 15,000 square feet to post an employee at each entry dedicated to monitoring compliance with face coverings and occupancy. The modified stay-at-home order is lifted which removes the curfew previously in place from 10:00pm – 5:00am. Retail occupancy limits remain unchanged as noted below.

Executive Order 195

EO 195 Frequently Asked Questions

Governor Cooper Press Release

DHHS COVID Metrics Slides

EO 195 is effective this Friday, February 26, 2021 at 5:00pm.

Changes included in EO 195 are noted below:

- Stores over 15,000 sf are no longer required to station a person at entry to monitor face coverings and occupancy

- Removes curfew previously in place from 10pm – 5am

- Alcohol sales for on-premises consumption extended until 11pm (was previously limited to 9pm)

- Outdoor businesses at 30% occupancy with no cap (previously capped at 100 people)

- The lesser of 30% or 250 people allowed at Bars, Taverns, Movie Theaters, Indoor Sports Arenas, Indoor parks

- Large indoor venues (5,000+ seats) may exceed the 250-person cap and admit guests up to 15% of fire capacity if they follow the additional required safety measures

- All outdoor venues are allowed 30% capacity (No cap)

- Mass gathering limit increased to 25 people indoors and 50 people outdoors (from 10 and 25)

Requirements Remaining in place:

- Store occupancy remains restricted to lesser of 50% stated fire capacity or 12 customers per 1,000 sf for social distancing can be maintained

- Retail businesses are required to have all employees and guests wear face coverings

- Mark six feet of spacing in lines at point of sale and other high-traffic areas

- Follow the core signage, screening and sanitation requirements as defined in EO 195 (see http://ncrma.org/coronavirus/)

- The allowance for mixed beverages to-go will continue through March 31

Don’t hesitate to reach out to NCRMA with any questions.

This afternoon, Governor Cooper announced an estimated timeline for vaccinations to begin in Group 3 beginning with anyone working in child care or in PreK-12 schools on February 24 and followed on March 10 with other frontline essential workers included in Group 3.

Governor Cooper Press Release – Group 3 Vaccine Timeline

Group 3 Estimated Timeline to begin Vaccinations:

- February 24: PreK-12 and Childcare Workers (~240,000 people)

- March 10: Group 3 frontline essential workers (as detailed below)

- Currently eligible groups – health care workers, long-term care staff and residents, and people 65 and older – will continue to be prioritized.

Group 3 Frontline Worker Letter Template: Many NCRMA members have inquired about NCRMA drafting a letter they can provide to their employees identifies them as a Group 3 or Group 4 essential employee. Please note that vaccine distribution is going to be on the honor system and based on the self-attestation of the employee. NC DHHS has confirmed that documentation is not required. NCRMA has drafted this letter template for Group 3 Frontline Workers to use, should you choose to provide one to your employees. NCRMA will follow-up with a similar letter for Group 4.

Included in Group 3 “Frontline Essential Workers” (approximately 583,000 people total): Healthcare and public health; Law Enforcement; Public Safety, and Other First Responders; Food and Agriculture; Community or Government-based Operations and Essential Functions; Critical Manufacturing; Commercial Facilities for Essential Goods; Transportation and Logistics; and Education.

- In order to be classified in Group 3, a worker must meet a two-prong test to be a “frontline essential worker”:

- they are required to report to a workplace and cannot do their job remotely and will be within six feet of other workers or customers and

- they are included in the ACIP category of workers as working in an essential worker.

- Within Group 3 who qualifies as “Commercial Facilities for Essential Goods?”

-

- Based on CISA and ACIP, this category is limited to workers in stores that sell groceries and medicine which would include grocery stores, pharmacies, convenience stores, dollar stores, super centers, membership clubs as well as retail businesses selling beverages.

- Within Group 3 who qualifies as “Food and Agriculture”?

- Based on CISA and ACIP, this category would include restaurant workers as well as food and beverage supply chain and distribution workers such as those working at distribution centers for food and medicine. CISA also lists individuals that work in greenhouses as well as the growth and distribution of plants and associated products for home gardens.

The NC Department of Health and Human Services (DHHS) has released additional guidance for employers of frontline essential workers on how to prepare employees for being vaccinated.

NC DHHS Employer Guidance for Vaccinating Employees

Reminder: North Carolina’s current prioritization plan:

Group 1: Health care workers & Long-Term Care staff and residents (547,000 people)

Learn more about Group 1

- Health care workers with in-person patient contact

- Long-term care staff and residents—people in skilled nursing facilities, adult care homes and continuing care retirement communities

Group 2: Older adults (1.2 million people)

Learn more about Group 2

- Anyone 65 years or older, regardless of health status or living situation

Group 3: Frontline essential workers (583,000 people)

Learn more about Group 3

- The CDC defines frontline essential workers as workers who are in sectors essential to the functioning of society and who are at substantially higher risk for exposure to COVID-19

Group 4: Adults at high risk for exposure and increased risk of severe illness (4.2 million people)

Learn more about Group 4

- Anyone 16-64 years old with high-risk medical conditions that increase risk of severe disease from COVID-19 such as cancer, COPD, serious heart conditions, sickle cell disease, Type 2 diabetes, among others, regardless of living situation

- Anyone who is incarcerated or living in other close group living settings who is not already vaccinated due to age, medical condition or job function

- Essential workers not yet vaccinated. The CDC defines these as workers in transportation and logistics, water and wastewater, food service, shelter and housing (e.g., construction), finance (e.g., bank tellers), information technology and communications, energy, legal, media, public safety (e.g., engineers) and public health workers

Group 5: Everyone who wants a safe and effective COVID-19 vaccination (4.5 million people)

Frequently Asked Questions

What Group of the Prioritization Plan is North Carolina currently in at this time?

North Carolina is currently in Group 2 of the prioritization plan – focused on individuals ages 65 years of age and older. There are approximately 1.2 million people in North Carolina in Group 2. NC DHHS is encouraging all counties to remain in the same group to fulfill that group’s vaccine needs before the state moves counties into the next group. It is estimated that the state is currently halfway through Group 2.

How did North Carolina decide which employees were included in Group 3 and which were in Group 4?

In determining which employees are included in Group 3 and Group 4 of the prioritization plan, North Carolina chose to use the recommendations from the Advisory Committee on Immunization Practices (ACIP) of the federal Centers for Disease Control (CDC) and apply the federal Cybersecurity and Infrastructure Security Agency (CISA) determination of essential critical infrastructure workers. ACIP split the essential worker classifications into two categories with some essential workers included in Group 3 and others into Group 4.

CDC Advisory Committee on Immunization Practices (ACIP) Recommendations

CISA Essential Critical Infrastructure Designations

Which essential workers are included in Group 3?

In order to be classified in Group 3, a worker must meet a two-prong test to be a “frontline essential worker”:

- they are required to report to a workplace and cannot do their job remotely and will be within six feet of other workers or customers and

- they are included in the ACIP category of workers as working in an essential worker.

Included in Group 3: Healthcare and public health; Law Enforcement; Public Safety, and Other First Responders; Food and Agriculture; Community or Government-based Operations and Essential Functions; Critical Manufacturing; Commercial Facilities for Essential Goods; Transportation and Logistics; and Education.

Within Group 3 who qualifies as “Commercial Facilities for Essential Goods?”

Based on CISA and ACIP, this category is limited to workers in stores that sell groceries and medicine which would include grocery stores, pharmacies, convenience stores, dollar stores, super centers, membership clubs as well as retail businesses selling beverages.

Within Group 3 who qualifies as “Food and Agriculture”?

Based on CISA and ACIP, this category would include restaurant workers as well as food and beverage supply chain and distribution workers such as those working at distribution centers for food and medicine. CISA also lists individuals that work in greenhouses as well as the growth and distribution of plants and associated products for home gardens.

How many people are in Group 3?

There are approximately 583,000 people in Group 3.

Which other essential workers are included in Group 4?

Included in Group 4: Workers that are employed in the Group 3 industries but who do not work on the frontline – meaning they can work remotely, or they are not regularly within six feet of other workers or customers. Also included in Group 4 are other essential workers who are not already vaccinated including: Chemical; Commercial facilities; Communications and information technology; Defense industrial base; Energy; Financial services; Hazardous materials; Hygiene products and services; Public works and infrastructure support services; Residential facilities, housing and real estate; and Water and wastewater.

Within Group 4 who qualifies as “Commercial Facilities”?

Group 4 is where most retail workers will end up being classified as CISA defines this category as “workers in retail and non-retail businesses – and necessary merchant wholesalers and distributors – necessary to provide access to hardware and building materials, consumer electronics, technology products, appliances, emergency preparedness supplies, home exercise and fitness supplies, and home school instructional supplies.”

NC DHHS “Find My Group” Tool:

https://findmygroup.nc.gov/

NC DHHS Updated Resources:

Flyers and Fact Sheets: Print and share flyers in your community.

- Bilingual – Your Best Shot Against COVID-19

- 65 years and older – English / Spanish

- Simpler Flyer – English / Spanish

- Postcard Size Handout – English / Spanish

Infographic: Use on your website and digital displays.

Videos: Post on social media, play on internal displays, and share on websites and in newsletters.

- English Video Library / Spanish Video Library featuring faith leaders, community leaders, frontline workers, older North Carolinians and more

Social Media Graphics: Post on your social media channels.

FAQs: Use a resource. Our frequently asked questions are updated weekly.

Presentation: Become a Vaccine Ambassador. Attend a presentation. Register now. These decks are updated weekly.

Collect and Share Stories: Share stories of people telling why they got or plant to get the vaccine. Use this tip sheet to record and share a video or photo.

Website: Link to our Vaccine websites.

This afternoon, Governor Cooper issued Executive Order 189, which extends the requirements of Executive Order 181. Originally scheduled to expire this weekend – Executive Order 181 has now been extended through Sunday, February 29th at 5:00pm to keep current requirements for citizens and businesses in place. The Governor also extended the allowance for mixed beverages to-go as set forth in Executive Order 190 and previous Executive Order 183 through Wednesday, March 31, 2021 at 5:00pm.

Executive Order 189: https://files.nc.gov/governor/documents/files/EO189-Further-Extension-of-Stay-at-Home-Order.pdf

New Executive Orders Issued also Incorporated by Reference:

- Executive Order 181

- Executive Order 183 (Incorporated in New Executive Order 190) – Mixed Beverages To-Go

- Executive Order 192: Hours of Service Transportation Waiver

Items of Note:

- Current occupancy restrictions remain in place.

- Businesses must close to the general public from 10 pm to 5 am.

- Workers may travel to and from work after 10 pm and workers may remain onsite to continue business operations after the business is closed to the public.

- Retail businesses that sell groceries, medication, fuel or health care supplies are not subject to 10 pm – 5 am closure provision.

- Delivery, drive-through, curbside pick-up and carry-out are also exempted from the 10 pm – 5 am closure requirements.

- On-Premise alcohol sales halted from 9 pm to 7 am. Off premise sales of beer and wine are still allowed.

Retail Requirements – Reminders:

- All retailers, regardless of size, are responsible for ensuring that every employee and customers wear a face covering at all times while they are inside the retail location.

- With regards to eating establishments – a customer must wear their face covering at all times when they are not eating and/or drinking.

- Retailers that have more than 15,000 square feet must maintain an employee at the entrance of the store responsible for two things:

- Limit Guests inside the store to Emergency Maximum Occupancy – the lowest number produced by applying the following two tests:

- Limit the number of Guests in the store so that everyone can stay six (6) feet apart.

- Mark six ( 6) feet of spacing in lines at point of sale and in other high-traffic areas for guests, such as at deli counters and near high-demand products.

- Follow the Core Signage, Screening, and Sanitation Requirements as defined in EO 181.

Enforcement can be through state law enforcement, DHHS or local enforcement authorities, and law enforcement may cite both the individual who fails to wear the face covering and/or the business or organization. The penalty for violating the Executive Order is a Class 2 misdemeanor, which could result in a fine of up to $1,000 or active punishment.

We continue to receive many questions concerning North Carolina’s prioritization plan for distributing and administering the COVID-19 vaccine. Specifically, there is confusion about who falls within the “essential goods” and “Food and Agriculture” categories that are in Group 3 versus employees of retailers and other businesses that are categorized as “commercial establishments” contained in Group 4.

As a reminder this is North Carolina’s current prioritization plan:

Group 1: Health care workers & Long-Term Care staff and residents (547,000 people)

Learn more about Group 1

- Health care workers with in-person patient contact

- Long-term care staff and residents—people in skilled nursing facilities, adult care homes and continuing care retirement communities

Group 2: Older adults (1.2 million people)

Learn more about Group 2

- Anyone 65 years or older, regardless of health status or living situation

Group 3: Frontline essential workers (583,000 people)

Learn more about Group 3

- The CDC defines frontline essential workers as workers who are in sectors essential to the functioning of society and who are at substantially higher risk for exposure to COVID-19

Group 4: Adults at high risk for exposure and increased risk of severe illness (4.2 million people)

Learn more about Group 4

- Anyone 16-64 years old with high-risk medical conditions that increase risk of severe disease from COVID-19 such as cancer, COPD, serious heart conditions, sickle cell disease, Type 2 diabetes, among others, regardless of living situation

- Anyone who is incarcerated or living in other close group living settings who is not already vaccinated due to age, medical condition or job function

- Essential workers not yet vaccinated. The CDC defines these as workers in transportation and logistics, water and wastewater, food service, shelter and housing (e.g., construction), finance (e.g., bank tellers), information technology and communications, energy, legal, media, public safety (e.g., engineers) and public health workers

Group 5: Everyone who wants a safe and effective COVID-19 vaccination (4.5 million people)

Frequently Asked Questions

What Group of the Prioritization Plan is North Carolina currently in at this time?

North Carolina is currently in Group 2 of the prioritization plan – focused on individuals ages 65 years of age and older. There are approximately 1.2 million people in North Carolina in Group 2. NC DHHS is encouraging all counties to remain in the same group to fulfill that group’s vaccine needs before the state moves counties into the next group. Based on the current amount of vaccine doses North Carolina is receiving each week, which is approximately 125,000 vaccine doses, and the estimated number of people contained in Group 2 it is NCRMA’s estimate that North Carolina will remain in Group 2 until approximately March 15, 2021, at which time North Carolina could move to Group 3.

How did North Carolina decide which employees were included in Group 3 and which were in Group 4?

In determining which employees are included in Group 3 and Group 4 of the prioritization plan, North Carolina chose to use the recommendations from the Advisory Committee on Immunization Practices (ACIP) of the federal Centers for Disease Control (CDC) and apply the federal Cybersecurity and Infrastructure Security Agency (CISA) determination of essential critical infrastructure workers. ACIP split the essential worker classifications into two categories with some essential workers included in Group 3 and others into Group 4.

CDC Advisory Committee on Immunization Practices (ACIP) Recommendations

CISA Essential Critical Infrastructure Designations

Which essential workers are included in Group 3?

In order to be classified in Group 3, a worker must meet a two-prong test to be a “frontline essential worker”:

- they are required to report to a workplace and cannot do their job remotely and will be within six feet of other workers or customers and

- they are included in the ACIP category of workers as working in an essential worker.

Included in Group 3: Healthcare and public health; Law Enforcement; Public Safety, and Other First Responders; Food and Agriculture; Community or Government-based Operations and Essential Functions; Critical Manufacturing; Commercial Facilities for Essential Goods; Transportation and Logistics; and Education.

Within Group 3 who qualifies as “Commercial Facilities for Essential Goods?”

Based on CISA and ACIP, this category is limited to workers in stores that sell groceries and medicine which would include grocery stores, pharmacies, convenience stores, dollar stores, super centers, membership clubs as well as retail businesses selling beverages.

Within Group 3 who qualifies as “Food and Agriculture”?

Based on CISA and ACIP, this category would include restaurant workers as well as food and beverage supply chain and distribution workers such as those working at distribution centers for food and medicine. CISA also lists individuals that work in greenhouses as well as the growth and distribution of plants and associated products for home gardens.

How many people are in Group 3?

There are approximately 583,000 people in Group 3 so NCRMA’s estimated timeline (based on current vaccine allocations) to complete Group 3 is likely middle to late April.

Which other essential workers are included in Group 4?

Included in Group 4: Workers that are employed in the Group 3 industries but who do not work on the frontline – meaning they can work remotely, or they are not regularly within six feet of other workers or customers. Also included in Group 4 are other essential workers who are not already vaccinated including: Chemical; Commercial facilities; Communications and information technology; Defense industrial base; Energy; Financial services; Hazardous materials; Hygiene products and services; Public works and infrastructure support services; Residential facilities, housing and real estate; and Water and wastewater.

Within Group 4 who qualifies as “Commercial Facilities”?

Group 4 is where most retail workers will end up being classified as CISA defines this category as “workers in retail and non-retail businesses – and necessary merchant wholesalers and distributors – necessary to provide access to hardware and building materials, consumer electronics, technology products, appliances, emergency preparedness supplies, home exercise and fitness supplies, and home school instructional supplies.”

Will NCRMA be providing a document I can provide to my employees as to which Group they are in?

Yes, many NCRMA members have inquired about NCRMA drafting a letter they can provide to their employees identifies them as a Group 3 or Group 4 essential employee. Please note that vaccine distribution is going to be on the honor system and based on the self-attestation of the employee. NC DHHS has confirmed that documentation is not required. The North Carolina Department of Health and Human Services has also provided a link (below) to help North Carolinians identify which Group they fall into for purposes of vaccine distribution.

NC DHHS “Find My Group” Tool:

https://findmygroup.nc.gov/

At 2:00 pm today, Governor Cooper and Secretary Cohen announced that North Carolina has adjusted their vaccination prioritization plan to move to vaccinating citizens 65 years and older (previously the category was 75 years and older) as early as tomorrow as a revised Group 2. Front-line grocery workers will be now be categorized in Group 3 regardless of age (previously these were split between 50 years of age and older and under 50 years of age).

Below are the new prioritization groups:

Group 1 – Healthcare workers

Group 2 – Adults 65 years of age and older

Group 3 – Specific Essential Front-Line Workers including front-line grocery workers

Group 4 – Adults under 65 years of age with chronic health care conditions

Group 5 – Everyone else

Andy Ellen, NCRMA President and General Counsel, participated as a member of the Vaccine Distribution Advisory Committee in a meeting at 7:30 am this morning and will be participating in a follow-up meeting of this Advisory Committee tomorrow afternoon. At this morning’s meeting, NCRMA advocated for a uniform statewide program of vaccinating employees as well as utilizing pharmacies to assist in administering the vaccine.

You can use these resources to keep your networks and communities informed about the safety and effectiveness of the vaccines, as well as direct them to information that will help them find local vaccination sites. Available in both English and Spanish, the materials include general information about COVID-19 vaccinations and North Carolina’s ongoing rollout that can help you inform people of all ages.

The NC Department of Health and Human Services website, YourSpotYourShot.nc.gov, has flyers, fact sheets, postcards in English and Spanish that we ask you to post, print and handout in places where people visit, and share in newsletters. Check the website often for new materials.

Message from NC State Health Director, Dr. Tilson:

As always, NC DHHS relies on you as a trusted messenger to help people make informed decisions and take action. In addition to the suite of communications materials (linked above), please feel free to use and share the video testimonials provided by NC DHHS:

- Older North Carolinians, You Have A Spot, Take Your Shot (English / Spanish / Captioned)

- Governor Jim Hunt on the importance of taking the COVID-19 shot

- Reverend Darryl Warren Aaron of Providence Baptist Church, Greensboro on the importance of taking the COVID-19 shot.

- More videos are online.

Elizabeth Cuervo Tilson, MD, MPH

State Health Director

Chief Medical Officer

NC Department of Health and Human Services

|

As a follow-up to the post from December 30th, NCRMA has been in touch with the State Health Director and Chief Medical Officer, Dr. Betsey Tilson, concerning a number of questions we have received about the process and eligibility for grocery store workers to receive the COVID-19 vaccine as part of the revised Phase 1b, Group 2.

As a reminder, below are the respective Groups for Phase 1b –

Group 1: Anyone 75 years or older, regardless of health status or living situation

Group 2: Health care workers and frontline essential workers 50 years or older

The CDC defines frontline essential workers as first responders (e.g., firefighters and police officers), corrections officers, food and agricultural workers, U.S. Postal Service workers, manufacturing workers, grocery store workers, public transit workers, and those who work in the education sector (teachers and support staff members) as well as child care workers.

Group 3: Health care workers and frontline essential workers of any age

- Click here for a Deeper Dive on Phase 1b

Among the questions NCRMA has sought guidance on are the following:

Where can grocery workers go to get the vaccine?

- Do they need any documentation to say they work at a grocery store or to prove their age?

- What qualifies as a grocery store – in many locations in rural and urban areas dollar stores, pharmacies, convenience stores accept SNAP and have all of the components of a grocery store, as do warehouse clubs and big box retailers.

- Which workers qualify as grocery store workers – is it everyone that works in the store?

- There are several grocery distribution centers in the State that ensure that the food gets to the grocery stores and that the food supply chain continues to operate – do these workers qualify as grocery workers or fall into the food and agriculture qualification?

Per Dr. Tilson, the State is currently working on guidance for Group 1 of Phase 1b which is for individuals over 75 years of age regardless of health status or living situation and will then provide guidance on the frontline essential workers including grocery store workers. We will relay all information and guidance we receive from State as soon as it is received. Also, you may want to contact your local health department to see if they have implemented additional measures especially since some vaccine doses slated for certain individuals may be going unused.

Updated Guidance on Covid-19 Vaccination Prioritization and Essential Workers

This afternoon, the North Carolina Department of Health and Human Services published clarifying guidance on Covid-19 vaccinations through a four-phase distribution plan described below. Additionally, the Department provided helpful infographics, for your use, of the prioritization by phase (click here) and on essential workers (click here).

Phase 1A: Health care workers fighting COVID-19 & Long-Term Care staff and residents.

- Health care workers caring for and working directly with patients with COVID-19, including staff responsible for cleaning and maintenance in those areas

- Health care workers administering vaccine

- Long-term care staff and residents—people in skilled nursing facilities and in adult, family and group homes.

- Click here for a Deeper Dive on Phase 1a

Phase 1b: Adults 75 years or older and frontline essential workers.

There is not enough vaccine for everyone in this phase to be vaccinated at the same time. Vaccinations will be available to groups in the following order.

- Group 1: Anyone 75 years or older, regardless of health status or living situation

- Group 2: Health care workers and frontline essential workers 50 years or older

The CDC defines frontline essential workers as first responders (e.g., firefighters and police officers), corrections officers, food and agricultural workers, U.S. Postal Service workers, manufacturing workers, grocery store workers, public transit workers, and those who work in the education sector (teachers and support staff members) as well as child care workers. - Group 3: Health care workers and frontline essential workers of any age

- Click here for a Deeper Dive on Phase 1b

Phase 2: Adults at high risk for exposure and at increased risk of severe illness.

Vaccinations will happen by group in the following order:

- Group 1: Anyone 65-74 years old, regardless of health status or living situation

- Group 2: Anyone 16-64 years old with high-risk medical conditions that increase risk of severe disease from COVID such as cancer, COPD, serious heart conditions, sickle cell disease, Type 2 diabetes, among others, regardless of living situation

- Group 3: Anyone who is incarcerated or living in other close group living settings who is not already vaccinated due to age, medical condition or job function.

- Group 4: Essential workers not yet vaccinated.

The CDC defines these as workers in transportation and logistics, water and wastewater, food service, shelter and housing (e.g., construction), finance (e.g., bank tellers), information technology and communications, energy, legal, media, and public safety (e.g., engineers), and public health workers.

Phase 3: Students

- College and university students

- K-12 students age 16 and over. Younger children will only be vaccinated when the vaccine is approved for them.

Phase 4: Everyone who wants a safe and effective COVID-19 vaccination.

Yesterday, the North Carolina COVID Vaccine Advisory Committee met to discuss the latest revisions to the Prioritization of how the COVID Vaccine will get distributed in North Carolina. NCRMA President and General Counsel Andy Ellen serves on this Advisory Committee. This latest revision is in response to the latest recommendations by the CDC’s Advisory Committee on Immunization Practices (ACIP) on December 22, 2020.

Dr. Betsey Tilson, the State Health Director, explained on our call that North Carolina would be closely aligning North Carolina’s prioritization with the ACIP recommendations but they would not mirror ACIP’s recommendations.

North Carolina’s revised prioritization is as follows:

Phase 1a largely remains the same as previous versions and focuses in on health care workers with a high risk to COVID as well as Long-Term Care facilities.

Phase 1b will now include individuals 75 years and older (mirrors ACIP) as a Phase 1b.1. Phase 1b.2 will include essential frontline workers over fifty years of age and Phase 1b.3 will include essential frontline workers under fifty years of age. Note that this is somewhat different in that ACIP had place all essential frontline workers in a larger Phase 1b. The term “essential worker” is based on the ACIP definition of the term which is different than the CISA version of the term. While it include grocery store workers and other in the food service industry the ACIP definition is not as expansive as the CISA definition of the same term. NCRMA is working to get clarity on whether other retail workers are included in this definition of essential worker. It is anticipated that NC could be in Phase 2 by the middle of January, 2021.

Phase 2 will include every person 65 of age and over, individuals ages 18-64 with high risk medical, anyone in congregate settings and essential workers that are not frontline.

We are also inquiring as to whether this new prioritization will be expedite the retail pharmacies administering the COVID-19 vaccine.

Please see attached (click here) and let me know if you have any questions.

In addition to numerous conversations with the Department of Health and Human Services this week, the North Carolina Retail Merchants Association sent the following request to Governor Cooper and Secretary Cohen yesterday to encourage the periodization of retail employees for the COVID-19 vaccine.

Governor Cooper –

On behalf of the North Carolina Retail Merchants Association (NCRMA) and its 2,500 members representing more than 25,000 store locations in North Carolina, I write to encourage the State of North Carolina to adopt the recommendations of the Centers for Disease Control’s Advisory Committee on Immunization Practices (ACIP) COVID-19 Working Group. On Sunday, December 20, 2020, by a vote of 13-1, the ACIP COVID-19 Working Group approved an updated privatization structure following Phase 1a as follows:

Phase 1b: persons aged ≥75 years and frontline essential workers

Phase 1c: persons aged 65–74 years, persons aged 16–64 years with high-risk medical conditions, and other essential workers

Included in the new ACIP COVID-19 Working Group recommendations for Phase 1b are frontline essential workers including grocery store workers and other retail employees who have remained on the job day-in and day-out since the onset of COVID-19. These frontline retail workers and their employers have worked tirelessly to provide a safe shopping experience for both customers and employees and ensure North Carolina consumers received goods and services. The list of retail workers who should qualify as frontline essential workers should include pharmacists, retail store clerks, distribution center workers and delivery drivers bringing goods to, and often into the homes of North Carolina citizens. Because these frontline retail workers are individuals who deal with the general public each and every day and do not have the option to work remotely, they have a greater risk of exposure to COVID-19 making them priority candidates for the COVID-19 vaccine as evidenced by the recommendation of the ACIP COVID-19 Working Group.

Since late fall, I have had the honor to serve on the North Carolina COVID-19 Vaccine Advisory Committee and commend Dr. Betsey Tilson and Amanda Moore for the amazing work they have done to this point and will do in the future to deploy the COVID-19 Vaccine. As the President of a business organization whose industry is dependent upon the success of the COVID-19 vaccine, North Carolina could not be in better hands than those of Dr. Tilson and Amanda Moore during this crucial juncture in the fight against COVID-19. Dr. Tilson and Amanda Moore have been thoughtful in their decision-making and have been true leaders throughout this process.

Again, the North Carolina Retail Merchants Association strongly encourages the adoption of the ACIP COVID-19 Working Group recommendations to include frontline essential workers including retail employees in Phase 1b of distribution of the COVID-19 Vaccine.

Late on Monday afternoon, Governor Roy Cooper issued Executive Order 183 which allows businesses holding mixed beverage permits through the North Carolina ABC Commission to sell “cocktails to go” either from the mixed beverage holder’s premises or through a Delivery Service Permittee. Executive Order 183 became effective at 5:00 pm on Monday, December 21, 2020 and expires on January 31, 2021.

Long-standing North Carolina law authorizing ABC mixed beverage permits have only allowed mixed beverages to be sold for consumption on the premises of the mixed beverage permittee. Executive Order 183 directs the Commissioner of the North Carolina ABC Commission to waive this limitation and allow mixed beverage permittees to sell mixed beverages to be consumed off-premises through either the purchaser taking the mixed beverage with them in a sealed container or through delivery by a Delivery Service Permittee. In Executive Order 183, Governor Cooper stressed that this would be an economic boost for restaurants and bars and also allow North Carolinians to better socially distance during COVID.

There is an extensive list of requirements a mixed beverage permittee must abide by in order to sell mixed beverages to go – these include but are not limited what is provided below. If you are a mixed beverage permittee and intend to offer mixed beverages or cocktails to go we recommend reviewing Executive Order 183 (click here) and the FAQs (click here) as violations of Executive Order 183 will impact your ABC permits:

- Each purchaser may only receive one mixed beverage and it must be in a sealed container and be maintained in the passenger area of the vehicle during transport.

- There may be multiple people at the same address with each being a separate purchaser but each purchaser of a mixed beverage must be present to receive the mixed beverage.

- A mixed beverage may only be delivered to the individual who purchased the mixed beverage and whose name appears on or with the mixed beverage container and must match the identification of the person who takes actual possession of the mixed beverage.

- Mixed beverages must be delivered within 50 miles of the permittee, to areas where mixed beverages sales have been approved and during applicable sales times (i.e. before 2:00 am).

- For any to-go sales, the mixed beverage permittee must provide a receipt to the purchaser that contains (i) an itemized list of the names and quantities of alcoholic beverages to be delivered; (ii) the name, address, and telephone number of the mixed beverage permittee; and (iii) the Purchaser’s name.

- The sealed container containing the mixed beverage to go must have the following information in type not smaller than 3 millimeters in height and not more than 12 characters per inch:

1. Drink name, or type of spirituous liquor the beverage contains.

2. Quantity of spirituous liquor.

3. Name of the person to whom the mixed beverage was sold, if the beverage is being delivered.